Planned Giving

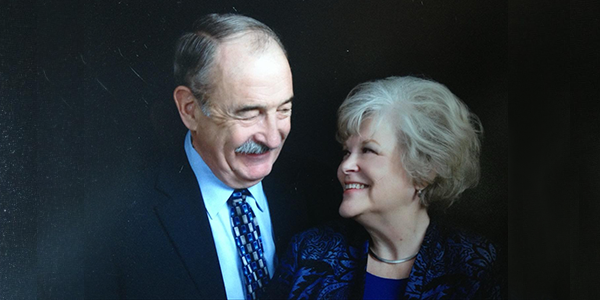

Trust God with your Flour and Oil

By trusting God with their flour and oil, Cheryl and Kelly have been blessed to be a blessing.

Click here to read more about their inspiration to support

God's work with their blessings.

IRA Charitable Rollover

An IRA rollover allows people age 70½ and older to reduce their taxable income by making a gift directly from their IRA.More |

Gifts of Stocks and Bonds

Donating appreciated securities, including stocks or bonds, is an easy and tax-effective way for you to make a gift to our ministry.More |

|||||

Gift Options

Find out What to Give and learn about the best assets to make a planned gift. Learn about gifts of cash, securities and property. Learn How to Give and discover gift options that provide tax and income benefits. Discover the best planned gift to meet your goals.More |

Washington News

In IR-2024-116, the Internal Revenue Service (IRS) outlined ways that late tax filers could comply with filing and...More |

|||||

The Lutheran Church-Missouri Synod Mission Advancement utilizes the services of the LCMS Foundation as our partner for gift planning legal support and trust management.